Many people who are faced with the problem of borrowing a significant amount are wondering. How to write a receipt correctly and whether it will be legal in nature.

Regardless of the fact that the document is called arbitrary, but is of a legal nature. In the event that financial or other valuables are not returned to borrowers within the agreed period.

The IOU specified in the legislation of the Russian Federation is a significant enforcement of the law, applied directly in civil relations. A detailed description of the legality of the document is indicated in Article 808 of the Civil Code of the Russian Federation.

Paragraph 2 states that the meaning of the written main contract, the receipt is provided as a supplementary document. It should not be forgotten that it must be presented directly as a separate legal document.

When to apply

In the Civil Code of the Russian Federation, there is Article 408, which states that the creditor, accepting the performance of the debtor, is obliged to write a document of performance in full or in part. After paying the debt, the borrower is obliged to return the corresponding receipt.

Due to the impossibility of the return to indicate in the subsequent document. In the form of the creditor's refusal to give a receipt, the debtor has the right to delay performance.

The receipt also confirms the condition of a business transaction in business, receipt of documents, expensive valuable items. The document can also record the provision of a service or the intention of any action. To do this, you need to specify the service of any kind and the period of provision. The document must be drawn up in writing and with an appropriate commitment.

There are also such lenders who use the dependent financial position of the person taking. Offering high interest on a loan has the ability to require long-term settlement. With the indicated percentages of assignment to receipts of this fact, one must be wary and not find oneself in a credit hole.

How to write a receipt

The transaction is considered completed and plays a role in cases of transfer of money, and not from the moment it is signed. Without the transfer of a monetary loan, the contract cannot be considered concluded. There is another way: a contract is drawn up, and the transfer of funds is indicated in the document.

The payment order will be the fact of confirmation of the transfer of funds to the borrower's current account, but first of all, an agreement is concluded. It may be written in the loan agreement that the funds are received by the debtor at the time of signing the agreement. Also, the receipt of funds can be correctly entered into the contract.

The debtor must write a receipt in the presence of the borrower and sign. If by deceit he does not provide his signature, then with the required examination he can prove not to participate in this transaction

Design rules

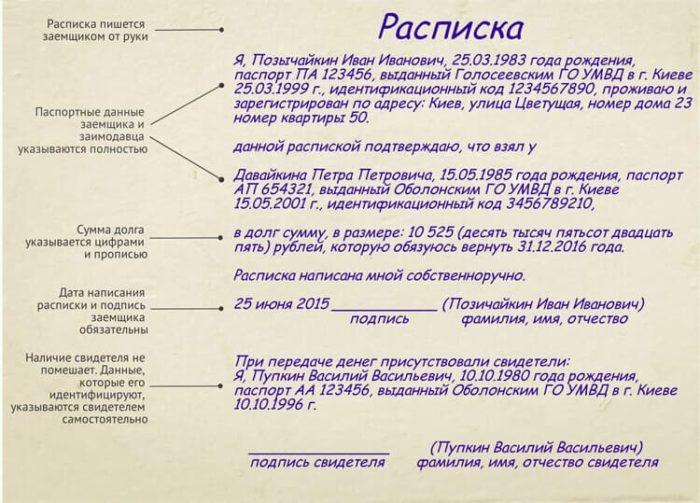

For minimal risk with a possible refusal of a refund, and recognition as illegal. It is required to comply with all the nuances of the rules for filling out a receipt, which include:

- A document drawn up without the use of any printing machines and other devices, in the event of a possible examination for presentation in court.

- Financial sums are written in numbers and in words for a period.

- With currency, it is filled in according to the exchange rate at which the refund will be made.

- In the case of an interest-free loan, the document does not provide information on interest.

- At the time of writing the document, the very fact of the transfer of funds at the time of preparation should be indicated.

- Must be indicated (place, city, district) in the preparation of the receipt.

- A receipt for finances invested in a business project is regarded as a commercial risk and funds are not subject to return.

- And also check the passport data of the borrower with those indicated in the receipt.

In cases of the general rule, the contract in the receipt, with the condition of interest, is drawn up without indicating the size, then it is equal to the bank rate. You can also specify in the document that it is interest-free. But in the event that the debtor has delayed the time of payment under the obligation to return finances. Then in the next period, a percentage may be added, which is regarded as liability for use under Article 309 of the Civil Code of the Russian Federation.

Required details

The debtor who took advantage of the credulity of the lender, without indicating the details when drawing up the receipt, may evade the return of the loan. To avoid any disputes, you need to correctly draw up a receipt.

Sample:

I am Ivanov Ivan Ivanovich living at the address: Altai Region, Barnaul, st. Novaya d.65 kv.7. document series No. 333777 issued on 03.03.2000. TIN 8……. Received on 02/02/2017. From the full name (full) of the person living at the address (full) also the data of the document. Ten thousand rubles (for any needs). I undertake to return the specified amount in full before (the date in full), in case of delay, pay a penalty in the amount of two percent per day.

Number. Painting. Signature (Ivanov. I. I).

In a similar way, etc. are compiled.

It is better not to make a mistake, make a copy of the recipient's passport data, and must also write; (money is loaned). The borrower is obliged to write the text of the receipt for receiving the money. In the case of writing something else, the debtor may evade the debt obligation.

7 Mandatory Compilation Requirements

The most important thing is that in drawing up, 7 mandatory details must be observed:

- Name of lender and borrower.

- Registration address, TIN, and full passport details of both parties.

- Subject of the loan (in numbers and words).

- Date, place and the fact itself in teaching.

- What time is the refund.

- Why is it given?

- Surname must be in full, initials and signature.

Do I need to draw up a receipt in the presence of a notary?

Some citizens believe that in fact the document does not require such certification. Because he won't betray the significant power he already has.

Although an appeal to a notary may carry an additional character of confirmation. The fact is that it is not a falsification and was drawn up in the presence of both interested parties. And it was signed by a capable person exclusively without any pressure.

In the case when the loan occurs in large enough amounts so that all the associated risks of losing funds are reduced to zero. It is required to draw up a certain interest-free loan agreement that has a great legal basis.

Is it necessary to write a receipt by hand?

Mistakes made when compiling

An indication of the purpose of the loan is unfavorable for the lender himself. In cases where the document indicates that the loan is taken for commercial purposes. An unscrupulous borrower may refer to an unfavorable state of affairs and has the right not to repay the money within the specified period.

There are cases when the debtor thinks in advance how to draw up a receipt in order to evade liability. Sometimes the situation is not in favor of the creditor, due to gullibility or ignorance of the rules of drafting.

In what fact of breach of contract will judicial intervention be required? Different situations are possible if the receipt was drawn up in confirmation. The borrower is in no hurry to return the appropriate amount within the prescribed period, then you need to go to court.

But still, before dealing with this fact, it is necessary, first of all, to demand a return of money from the debtor in writing. Only in the case after a month, the notification did not bring any result, then you can file a lawsuit.

For the preparation of a competent claim, it is advisable to contact the legal department for advice. To the leading specialist where you will be helped to compile it.

Is it possible to demand a refund through the court. Having evidence in the form of a bank statement indicating that the funds were transferred to the debtor's account. To do this, you need to draw up requirements, hand them over to the borrower and insist on the return of the entire amount within 3 months.

This procedure is established by Article 810 of the Civil Code of the Russian Federation, if the amount of the debt is not returned within the established amount, then you can go to court with this.

NOTE: The limitation period is 3 years from the start of the refund period. In the case after the expiration, the statement of claim will be denied.